AIM Awards 2024

In June I delivered a rather tongue in cheek pretence of being upset that I had not been invited to the Small Cap Awards. This week I would have missed the fact that the AIM Awards are to be held on October 10. Indeed, I only found out about this when someone looking told me they had been invited by a service provider, e.g. accountant, lawyer, broker etc.

Once again I was stung as I have not been invited. This is perhaps not so much a gripe against my myriad of service providers, but on the feeling that there are few people in the country who do more to promote AIM and the small caps, at least in my mind. Of course, there are many who say they do, and many who live off them. But few who actually do anything to popularise the genre in this country. Indeed, as we look forward to whatever disastrous interventions the new government will come up with on October 30, the AIM market needs more than a few hundred people patting themselves on the back at Old Billingsgate – without me!

UK Budget / US Election

Given the lay of the land as far as the UK Budget and US Election, one wonders how / why anyone is investing? Of course, wise heads might suggest that the horror of the Halloween Budget has already been factored in. They might also suggest that even if everyone in the USA votes for Donald Trump, he will not become President again off the back of whatever alleged dark forces.

This week Peel Hunt waded into the debate via CityAM, saying that the above two factors could lead to a market slowdown. You don’t say. Rather worse was an article in This is Money, revealing that since Rachel Reeves’ “black hole” perspective of the economy, investors have pulled the devil’s number, £666m from UK focused equity funds. This is a kick in the proverbials that has so far gone largely uncommented, and of course, unpunished. At the same time we do not have an Stock Market Tsar, to represent and underpin the market. Obviously, the Labour market do not care about the damage they have already caused, and what they are going to do, as they just tax people even more. Simple.

Call My Bluff

I have to admit that while working I tend to have YouTube on in the background. It will randomly play videos, presumably based on my viewing algorithm. Therefore, it was with great joy I noticed that the old word meaning panel game show, “Call My Bluff” appeared. The best in my view were from the 1975 to 1985. Of course, now one can Google words in seconds. But watching the great and the good of that time, many of whom are no longer with us is a delight. And we are also reminded of how far we have sunk compared to the present day equivalent “celebrities.” There is a slight read across to the stock market on Call My Bluff, in the sense that at 7am one is very often trying to work out whether a RNS is bullish, bearish, or just bluffing.

Investors Chronicle

It must be a year or more since I read the IC, what was of course the stock market bible in the 20th century. In the 21st century, things have changed, not least given the presence of (psychotic) bloggers, self-proclaimed online experts, and armchair fintwit investors. All these arrivistes have in general muddied the waters, and it is understandable that some punters just settle for Simon Thompson in the IC (who always seems to win at the AIM Awards), or Joanne Hart at the Mail On Sunday. I have to say that reading the IC after a break, the macro / economic views one can take or leave. The personal finance stuff, one can also ignore. As a separate comment, one wonders how some of the writers managed to wangle their way into writing for the IC, with their Mickey Mouse / ABC style, but perhaps that is what was asked for. But the small cap area of the magazine– manned by Mr Thompson, is worth a read for all fans of the minnows.

A good example was his analysis of compulsive spin off of pie in the sky concepts like GenIP (GNIP) this week, Tekcapital (TEK). The problem is that you can wax lyrical about all the book values, p/e ratios, NAV et al. But the stock market does not care. It also does not care about how cheap a stock is if it does not like the management. This is over and above the current UK stock market rule, that everything is given a massive valuation haircut. This may be because we are working hard on being the world’s newest banana republic, or just that the culture of this country remains anti-wealth creation.

As an investor friend of mine emailed me this week, even gold would trade on a 30% if the commodity were listed on AIM. I added that the discount would remain even if God was the CEO of the company. I understand that Simon Thompson has to go through the traditional motions of valuation / economics. But apart from the clout he has with his gig at the IC, same with Joanna, I do not think the market works like it used to, and perhaps never will. All we perhaps do know is that cashflow is king.

Top Bulletin Board Heroes Risers

I would contrast the paragraph above with mainstream journalists’ efforts, with what the daily Bulletin Board Heroes video does. The list below shows the top twenty risers of the past month. As regular viewers of BBH will know the goal of the daily 10 minute video is to identify the top new near term risers over the next 4-6 weeks. As regular viewers of the video will also know, Mobile Streams (MOS), Global Petroleum (GBP), Tower Resources (TRP), Blackbird (BIRD) and Cora (CORA) have appeared multiple times in the recent past, and from near their lows.

The same is particularly true for Celadon (CEL), Emmerson (EML), Kore Potash (KP2), Cyanconnode (CYAN) and Argent Biopharma (RGT). What is perhaps ironic is that more people would probably take note of charting / technical analysis, if they believed that predicting the future in small caps could actually be done. It also perhaps does not help that many of the people who are predicting stocks are also selling you a course on how to predict stocks.

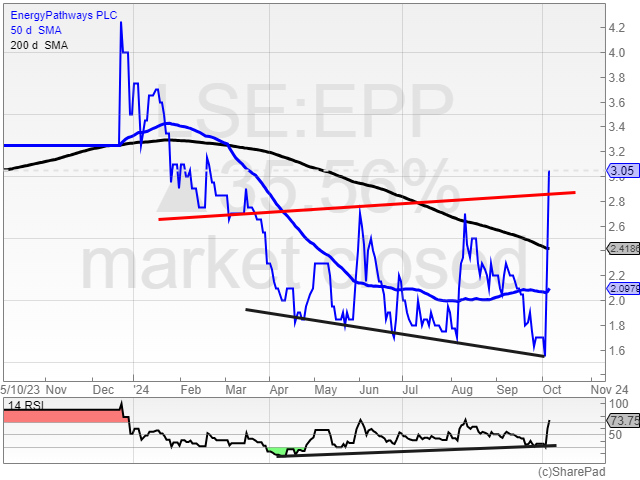

EnergyPathways

The highlight of the week in the small cap area was EnergyPathways (EPP), with the £5m non dilutive funding well received. Of course, there is an irony here that listed companies are increasingly relying on private sources of funding, something which rather undermines the point of being listed. As far as EPP is concerned, there is no doubt that this is good news, and that the shares with the current £5m market cap can continue to re-rate. It may also be the case that the share price rise – although still well off their listing price of 4p when the company raised £2m, is largely a factor of shorters guessing the company was going to run out of cash, and then covering their positions.

But one wonders how patient the market will be in waiting on the final investment decision on the MESH project in a year’s time, and how much more cash will be needed for it? This kind of infrastructure project tends to have a rather longer timeframe, and larger budget than the public markets can stomach. It can also be seen these days that many small cap companies are going for energy storage, when one wonders how much domestic energy, especially oil and gas, there will be to store if crackpot Minister Ed “Headstone” Milliband gets his way.

But one wonders how patient the market will be in waiting on the final investment decision on the MESH project in a year’s time, and how much more cash will be needed for it? This kind of infrastructure project tends to have a rather longer timeframe, and larger budget than the public markets can stomach. It can also be seen these days that many small cap companies are going for energy storage, when one wonders how much domestic energy, especially oil and gas, there will be to store if crackpot Minister Ed “Headstone” Milliband gets his way.

Zenith Energy

Litigation plays on the London market have been a “close but no cigar” affair historically. But we seem to be getting closer, towards the end of 2024, if only because we have already waited so long as far as the likes of Panthera (PAT), Ascent (AST), and now Zenith Energy (ZEN). What such stocks enjoy is the aforementioned London market habit of over discounting prospects, and therefore one really is getting a play with none of the sizzle attached until the day it happens. This may be the case with ZEN, although this week off the back of its fully-owned subsidiary Anglo African Oil & Gas Congo SAU receiving payment of €30,000 after legal action against SMP Energies. Given that ZEN is claiming as much as €9m against SMP, perhaps buyers of the stock are counting on the initial payment just being the tip of the iceberg as far as a litigation win is concerned. Given that a conclusion here could be achieved well before the end of this year, we may see more of a rebound in ZEN, in anticipation of such a result.

East Star Resources

Of course we know that the London market hates companies on the stock market raising money, even though or perhaps because the purpose of being on the stock market is to raise money. But even within the context of current conditions, the share price performance of East Star Resources (EST) ahead of the oversubscribed placing at 1.15p raising £1.2m was taking the mickey. The shares were trading at 4p in early July, and obviously the rug was pulled from under the stock as someone, somewhere clearly guessed a placing was on its way. But this actually provides an opportunity in the sense that the stock is now so low in the range, that a bounce should be on its way.

Predator Oil & Gas

The award for price target of the week went to Oak Securities, with its initiation note on Predator Oil & Gas (PRD). Shares of PRD have been a firm market in recent times, a point witnessed by the way that in its fundraises the company’s share price remained strong. Now all cashed up and with the big reveal due at MOU-5 in coming months, the 148p price target is one to watch. On Friday, Oak said of the MOU-5 exploration well in the Guercif licence, Morocco: “This well is targeting a 5.9 TCF gas prospect with the potential of additional value added from helium being present. Using a RENAV we derive a value of 111 p/share from the natural gas and 36p/share from the helium. This gives combined value and target price of 148 p/share.”

Click on the link below for the Oak Securities report:

20241004 Predator Oak Securities Initiation

The Week’s Interviews

Finally, this week I ventured out to a studio in Southwark to interview Jason Brewer, of Marula (MARU), Unicorn (UMR), Neo Energy (NEO) fame, among others. There are a couple of points to note here. The first is that the 15 minute was done in one take, did not need anything edited / cut out, and unlike most fawning interviews by cowboys / amateurs we are treated to these days, was an interesting listen. I intend to do more.

The podcast interview with David Palumbo of EQTEC (EQT) highlighted the new strategy for the global technology innovator, and its new operations director, Murli Bhamidipati.

Charles Dickson, Executive Chairman, Roadside Real Estate (ROAD) explained the latest disposal / acquisition news, and the opportunity for the group, especially in terms of the EV rollout.

Author