The Cliff Edge

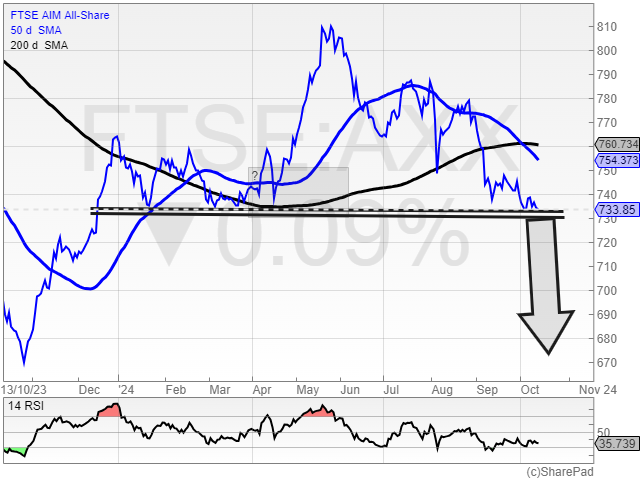

One of the best and worst things about the stock market is that it is rarely dull. Indeed, the particularly scary times are when it is dull and when we are sitting and waiting for an event. This may be unemployment data, inflation, growth et al. However, the run up to the October 30 Budget has to be one of the biggest cliff edge moments in recent history. This is shown on the daily chart of the AIM market, where it is all about the 730 level. We have a potential head & shoulders top on the index, which has been mapped out since December. Below it not only risks a retest of last October’s 670 low, but as low as 580, on a measured move basis from the May 610 high. Only back above 760 would kill the negative pattern.

How did we get here? Well, we all know by now. The warning of a “painful” budget from the Labour government has been the equivalent of a profits warning on the UK, made even worse that unlike the Liz Truss mini-budget, it is an own goal even before the match has started. Who does that? The answer is that someone who may be on the side of working (class) people, but not on the side of the stockmarket, landlords, pensioners, those who oppose open borders, entrepreneurs, or those who want to send their children to private schools. At the last count this amounts to a fair majority of the population.

There is a question as to how a government in its first 100 days can apparently want to cause so much damage, and not appear to know what it is doing. In fact, the point that many still do not realise is that the government is exactly on track with its aims. They are to ensure that there as few sources of independent wealth as possible, so that there are as many working (class) people as possible voting for it. As Thatcher said, socialism is dependency on the state.

Investment Summit

What is strange is that this up the workers mentality is actually still going. All the Labour governments since the war ended in failure (as to be fair many of the Conservative ones. However, the aforementioned Thatcher ande her government was truly the one that gave the game away as far us knowing that it is only a wealth creating, low tax, small state system that works. Nothing is of course perfect. But economic nirvana is more likely to come from businesses driving the economy, rather than government. We are reminded of this in the run up to the government’s investment summit tomorrow. Given the lay of the land on CGT, IHT and national insurance, one would wonder why anyone would bother to turn up. Indeed, the recommendation would be to would be attendees not to bother, given that in two weeks’ time the UK could be one of the last destinations cash should go to. This is a point witnessed by the Biblical scale exodus of millionaires from the country we have already seen. They all know that as Churchill said, you cannot tax your way to prosperity. Even worse, the amount of cash required by the government always expands to the money it has.

That said, all of the above is nothing new, and has been ignored by successive governments. As I have said before, the implication is that writers / journalists write because they are trying to illicit change. This is not the purpose of the Week In Small Caps. I know that this article is not going to change anything. Ironically, the closer such an article it is to being correct, the less chance there is of being heeded.

Pulsar Helium

As we are all aware the London stock market needs as many new companies, and IPOs as possible. One of the highlights of the year has been how broker Oak Securities has been so active in bring companies to market this year, rather like most who either just complain, or pretend to help the situation, or just enjoy a jolly at the AIM Awards. The latest after the likes of Helix Exploration (HEX), Georgina Energy (GEX), and Rome Resources (RMR) is Pulsar Helium (TSXV:PLSR). I have covered and interviewed the company since it listed in Canada in August 2023, and noted the 5x rally in the shares as it found the largest helium asset in North America in February. Given that the company achieved what few by definition have so far managed to do, the omens are good for the listing later this month. Indeed, a little help was provided today by the spotlight of Thisismoney covering the story.

https://www.thisismoney.co.uk/money/markets/article-13953009/Canadian-helium-firm-Pulsar-plans-London-float.html

Avacta

Speaking of journalists / writers, this week there was a minor storm in a teacup regarding a certain life sciences company developing innovative, targeted cancer treatments. Given my age and lifestyle choices, I would regard myself as being a direct beneficiary should Avacta (AVCT) getting over the line. However, a comment that the RNS on Thursday from the group was perhaps a little too “rocket science” met with a certain amount of kickback from some on X. It was suggested that I was commenting without appropriate research or knowledge. Au contraire, I have been reading every RNS for years. What I was saying is that the news release probably went over the head of many investors, or potentially investors, and that if made easier to understand rather than the shares being 58p, they could be 100p, or 200p. Those who did not understand this relatively simple point probably did not understand the RNS either.

Premier African Minerals

Avacta (AVCT) was discussed in the Weekend Markets videocast with Steve Deacon. And as we normally do, Premier African Minerals (PREM) was given a mention. Steve normally delivers a gritty rundown of the company, and it was interesting that the video on Friday coincided with the shares actually rebounding 42% on the day. Perhaps the last funding on October 3 has finally steadied the ship?

Vast Resources

Vast Resources (VAST), another company where there is a battle between the bulls and bears of epic proportions (largely in favour of the bears), was also another unlikely riser to end the week. This came off the back of news that a longstanding claim has been settled. The shares were up 28% on the week, something which was perhaps a factor of this news being the first in a while to change the negative direction of flow here. It was also perhaps due to a bounce after the overly negative RNS the company was made to deliver at the end of last month.

GreenX

A company whose shares were up 14% this week was GreenX (GRX). The interest here is that the rise was only this rather measly amount. It reported a successful outcome of the international arbitration claim against the Republic of Poland being awarded approximately £252m. One would have thought that the market could have been a little more generous here. A quarter of a billion is not pocket change for a £120m company. Perhaps it is waiting to see the cash actually hitting the account? Indeed, the shares temporarily peaked at 70p, a market cap approaching £200m, so the hope is that they will return to that zone soon.

Interviews

This week a couple of CEOs dropped by to be interviewed on ZaksTradersCafe.com. Interestingly enough, I note that this week quite a serious small cap chose to be interviewed by a new entrant in the PR/IR space. What is notable is that some listed companies seem happy to be interviewed by any fly by night individual who knows how to send a zoom link. No apparent City experience, no journalistic experience, and no social platform following required. This may be one of the reasons that so many companies are not getting the investor appreciation they deserve on the London market. It also underlines that so many listed companies really do not understand PR/IR.

I spoke to MetalsOne’s (MET1) Jonathan Owen once again, where the share price has not felt the benefit of what has on a fundamental basis been a very good year to date. The highlight was perhaps the doubling of the resource estimate at Black Schist in July. But as is sometimes the case with explorers, the market can get fixated on the funding required for development once assets have been proved up. What the market seems to be missing to quite a significant extent is the prospect of non-dilutive funding coming in from the EU, given the company’s strategic position in Scandinavia. If the market can deliver a 4x rally for Guardian Metal (GMET) on the back of potential US government grants, then it can do the same for Metals One. Come to think of it, Blencowe (BRES) deserves a similar rally given the way that since it announced it was receiving $5m from the US International Development Finance Corporation at the beginning of the year. What the shares are doing anywhere near 5p remains something of a mystery, given the massive validation of the DFC.

SEEN

One of the aspects of the stock market that we were reminded of this week is how important patience is. The good news at SEEEN (SEEN) is actually double good news. The pesky seller who has been hanging around the stock is apparently no more, and their departure (as is typically the case) appears to be coinciding with the long-awaited fundamental turnaround in the stock. Given that we are in a world where video content is king, those seeking to monetise such content, with SEEEN’s services, are flourishing. The sports sector looks to be particularly ripe for the company to exploit.

Author