STOCK MARKET NEWS – RNS HOTLIST

RNS Hotlist September 6: Ananda, Andrada, Atlantic, BATM, Bezant, Hydrogen Future, Kodal, Mosman, REACT, SEEN, Tekcapital, URA, Zenova

06/09/2023

Powerhouse Energy Group (PHE), the UK technology company, announced its unaudited half year report for the six months ended 30 June 2023. The company said the profit and loss statement in this half year report does not, in its view, reflect the true trading potential of the company. Following the acquisition of the Protos SPV, the revenues reported last year in servicing the Protos project have now been internalised, and so are reported as a cost. Meanwhile the acquisition of Engsolve occurred late in the period, so minimal benefit from Engsolve revenues is recognised in these accounts. The company also said that Keith Riley has stepped down as Acting Chief Executive Officer and as a director of the company. Paul Emmitt, the Company’s Chief Operating Officer, has agreed to become Acting Chief Executive Officer.

Comment: These days it is indeed difficult for a company to deliver a positive glow on its results, something which is as much a distortion on the negative as the positive as compared to days of old. We can look forward to the very capable Paul Emmitt as new CEO.

Ananda Developments plc (AQSE: ANA), a company developing cannabinoid medicines for the treatment of chronic inflammatory pain conditions, is pleased to announce that it has issued 600,000 of £1 each denomination unsecured, interest-bearing convertible loan notes. The company said it was grateful for the support of the additional funding from existing shareholders which will allow it to progress our strategy to pursue further clinical trials into inflammatory pain conditions. The House of Commons Home Affairs Committee report on Drugs, which was released last week, called for further government support for clinical trials into cannabinoids which aligns directly with Ananda’s strategy of providing randomised controlled trial evidence for the use of its MRX1 cannabidiol medicine in the treatment of chronic pain.

Comment: Hopefully, now that Ananda has got this CLN out of the way, it can propel its business strategy and become a game changer in the treatment of chronic pain. One would expect the share price to bounce back sharply after recent weakness ahead of today’s news.

Andrada Mining (ATM), an African technology metals mining company, provided assay results for the first batch of Reverse Circulation exploration drilling results of an initial scouting programme undertaken within the ML133 mining license area. The company said these initial results further highlight the mineral potential of our mining licenses and the Erongo region in general. It has found high-grade mineralisation within all its license areas over the last 12 months with indications that there is more to be found at depth.

Comment: Things are really ramping up at ATM to start September, and the prospect of high-grade mineralisation, and more at depth should start to add to the recent recovery in the share price. This is particularly so after this week’s funding news.

Atlantic Lithium (ALL), the African-focused lithium exploration and development company, announced further assay results from the resource and exploration drilling programme underway at the Ewoyaa Lithium Project in Ghana, West Africa. The company said it was pleased to report ongoing drilling assay results across the Ewoyaa Lithium Project, which have returned high-grade infill and extension intersections. Further results from the Ewoyaa South-2 and Ewoyaa North-East deposit have extended mineralisation outside of the current Resource envelope, including 48m at 1.13% Li2O from 137m at Ewoyaa South-2, where mineralisation remains open along strike and at depth.

Comment: ALL continues to fight back after the rather spurious shorting scare earlier in the year. Indeed, if the company plays its cards right it could actually find itself in a much better position that before the bears struck.

BATM (BVC), a provider of real-time technologies for networking solutions and medical laboratory systems, announced that it has received a new cyber security contract, with a value of $3.4m. The contract is for the provision of the Group’s advanced software-based cyber solution to its long-standing government defence department customer. The company said it was very pleased to have received another significant contract for its best-in-class cyber security solutions, and only eight months after receiving our last substantial order.

Comment: A true kerching moment for BVC. It is to be hoped that this chunky contract will move the dial in terms of market appreciation of the stock.

REACT Group (REAT), the specialist cleaning, hygiene, and decontamination company, announced it has been awarded an initial two-year contract to provide regular window and signage cleaning services to an established fast growing variety store chain covering c.700 national retail outlets based in high streets, retail parks and shopping centres throughout the United Kingdom. The contract, which begins in October, has a total life value of approximately £500k, with potential for growth from additional services and new store openings. The company said it was excited to have another prominent and well-known brand choose to appoint REACT to a national contract, recognising our strength through our LaddersFree business to provide consistently high-quality services at great value across the whole of their UK estate.

Comment: REACT continues to deliver the goods as far as adding momentum to its business, something which is underlined in the way that the stock is now nearly double what it was this time last year.

Mosman Oil and Gas (MSMN) the oil and gas exploration, development, and production company, announced the Year Three report on EP 145, its exploration block in the Amadeus Basin in central Australia, has been lodged with the Northern Territory Government. The company said it was pleased with the significant technical work managed by Dr Julie Daws. It looks forward to increased drilling activity from third parties in the Amadeus Basin with several wells scheduled to commence later in 2023.

Comment: MSMN needs all the good news it can get after the board departures earlier this week. Proper operational progress is required in spades for the rest of the year to get the stock price back on track.

Tekcapital (TEK), the UK intellectual property investment group, announced that Guident ltd has established a new subsidiary to facilitate the commercialisation of their regenerative shock absorbers (RSA). The subsidiary will contain Guident’s RSA intellectual capital including patents, licenses, industrial designs, proprietary data, know-how and relevant team members. Guident said that in light of its recent successes in collaboration with various independent test authorities, it is thrilled to announce the integration of RSA technology into a new dedicated subsidiary named ReVive Energy Solutions, ltd. This strategic move allows it to sharpen its focus on a precision-targeted go-to-market strategy for this what it believes is a revolutionary product.

Comment: It has been pointed out by the cognoscenti that shares of TEK remain at a deep discount to the sum of parts, something which we are reminded of in the wake of the latest Guident update.

Bezant (BZT) updated on further positive results of Phase 2 metallurgical testing carried out by Wardell Armstrong International on a sample from its 100% owned Kanye manganese exploration project in Botswana. The primary objectives of the testwork were to optimise the leaching conditions to achieve high manganese recoveries at more economical conditions relative to the previous phase of testwork and to benchmark the project against other manganese projects. The company said this is an excellent result and it will now fast track its preliminary economic assessment, whilst progressing its resource definition by further drilling and modelling.

Comment: Shares of BZT have started to stir from the lower levels of late, with this latest RNS regarding Botswana likely to help the process of recovery.

Kodal Minerals (KOD), the mineral exploration, and development company focused on lithium and gold assets in West Africa, announces its final results for the year ended 31 March 2023. The company said it is now on the final furlong with its pre-construction activities at Bougouni and is well positioned to break ground and start building our mine once its funding transaction with Hainan has been finalised in the coming weeks.

Comment: Once again KOD underlines to the market that funding will be finalised in the coming weeks, hence there is no reason for the stock to be any lower than it was at the peak earlier in the year near 0.9p.

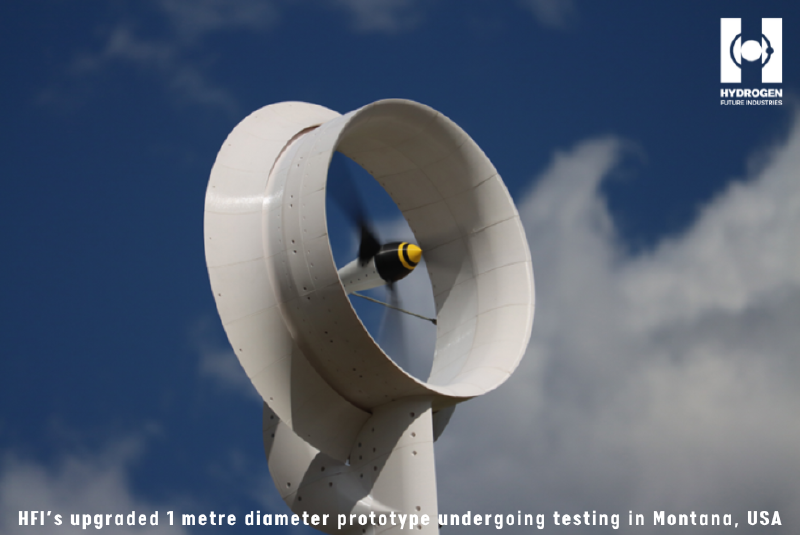

Hydrogen Future Industries plc (AQSE: HFI), a developer of a proprietary wind-based green hydrogen production system, updated on its testing and development activities, including initial data which is supportive of wind tunnel results from earlier prototypes. The company said it was delighted with the progress of prototype testing in Montana with limited initial data corroborating wind tunnel results. Historical wind tunnel data demonstrated a 357% increase in energy generation compared to open rotor wind turbines of the same diameter. This would put us on course to meet our goal of producing green hydrogen for under $2 per kilogram.

Comment: While HFI remains something of a dark horse, something which rather comes with the territory when a company is on Aquis, it can be seen that the 357% bump in energy generation is a massive development, and could be transformational down the line.

Zenova Group (ZED) said it was especially pleased to announce Dulux Decorator Centre, UK and Europe’s largest paint and decorating manufacturer have been officially appointed distributor and stockist of the paint ranges of Zenova Group. Dulux is a principal subsidiary of AkzoNobel Group, the world’s 4th largest consumer and industrial coatings business. ZED said having a global house hold name such as Dulux Decorator Centre appointed as a Zenova stockist is an important milestone in the Zenova growth story. As well as the endorsement afforded to Zenova products by an industry leader, it provides a material extension to our current sales team through the Dulux Decorator Centre network across its 230 plus stores and specialist specification teams.

Comment: Getting together with Dulux is nothing to be sniffed at for Zenova, and explains why the share price chart has been looking top grade in terms of a recovery set up in the past week.

SEEEN (SEEN) announced its holding a Technology Day to demonstrate its CreatorSuite 2.0 sofware, on Thursday the 14 September 2023. This new proprietary AI Driven software delivers customisable, Shoppable Video Prompts, SVPs are used by customers in advertising and video commerce to drive added return on investment. There will be a case study showing how this works in practice. Seen, reported losses for the December 2022 year-end reflecting the stage of investments with R&D testing and certification. CreatorSuite 2.0 seems to be gaining traction as since the year-end there are two new strategic customers worth more than $1m in revenues and $0.25m annual GP so the cash burn rate is reducing. The net cash of cir. £1.7m suggests no immediate funding requirement.

Comment: As technology gets ever more sophisticated its ‘value-added’ becomes harder to understand which can undervalue the market opportunity. Seen’s Technology Day next week will help redress the balance. The Technology Day will take place at The Hallam Conference Centre, 44 Hallam Street, London W1W 6JJ at 3.00pm BST. Video access to the Technology Day will also be made available to registered participants. To register for the Technology Day, please click the following link: seeen.com/techday

URA Holdings (URAH), an exploration company with assets in both the Republic of South Africa and Zambia whose shares are traded on the Main Market of the London Stock Exchange, is pleased to announce an operational update for its 74% owned Gravelotte Emerald Mine. The company said it was delighted to report that it continues to make good progress with restarting emerald mining operations at Gravelotte. It was impressed with the testwork results, quality, price and delivery time of the Angelon optical sorted following its visit to their facility in China and is happy to report that it has placed its order with them. With its JORC (2012) resource estimate of 29 million carats of contained emerald, and a further potential from exploration of between 167 and 344 million carats, Gravelotte can once again become a world leading emerald producer.

Comment: It should be all systems go now for the share price of URA, given the way that it is in the final furlong ahead of production. The market still apparently needs to be reminded of the 167 – 344 million carats at Gravelotte, otherwise the shares certainly would not be still less than 3p.

Disclaimer & Declaration of Interest:

The information, investment views, and recommendations in this Zaks Traders Cafe interview are provided for general information purposes only. Nothing in this interview should be construed as a promotion or solicitation to buy or sell any financial product relating to any companies under discussion or referred to or to engage in or refrain from doing so or engage in any other transaction. Any opinions or comments are made to the best of the knowledge and belief of the commentator but no responsibility is accepted for actions based on such opinions or comments. The commentators may or may not hold investments in the companies under discussion.

RECENT POSTS

Filter

Author