Jubilee Metals Group (JLP), a diversified leader in metals processing with operations in Africa, is announced its audited results for the year ended 30 June 2023. JLP said it was pleased to report another year of significant growth at Jubilee in which it has demonstrated its ability to navigate through some challenging infrastructure conditions. The company successfully countered the sharp drop in the PGM basket price by expanding its chrome operations into higher-margin offtake agreements, resulting in a robust net cash position and strong cash generation.

Comment: The market has so far managed to ignore JLP’s robust cash position and strong cash generation, and decided to focus perhaps on commodities prices. If there are value investors around in current stock market conditions, they would be looking at JLP near the low end of the range as a decent play.

Pires Investments (PIRI), the company focused on next generation technology, noted the announcement by its portfolio company, Smarttech247 (S247), that it has entered into a strategic partnership with cybersecurity giant, Splunk Inc (NASDAQ: SPLK). PIRI said the partnership between Smarttech247 and Splunk Inc. clearly demonstrates Smarttech247’s progressive approach to cybersecurity and is further evidence of the progress that the company is making in the cybersecurity sector.

Comment: It seems appropriate that the company soon to be known as Mindflair (MFAI) is updating one what is perhaps its best stand alone and understandable winning investment in Smarttech247.

Mila Resources (MILA), the post-discovery exploration accelerator, updated shareholders on progress with Liontown Resources Limited (ASX:LTR) regarding its arrangements to enter into a JV and assay results from the recent RC drilling programme at the Company’s Kathleen Valley Gold Project in Western Australia. MILA the recent assays from its relatively limited drilling programme have helped it to better understand the direction and diameters of the gold mineralisation at the Project. These suggest that the gold is focused, aiding its understanding of the structure. It embarked on this drilling campaign to understand the structure of the orebody and each drill hole provides further intelligence to prove up its geological model that it is highly structured, featuring concentrated zones of high-grade mineralisation.

Comment: Perhaps not surprisingly in the wake of the transformational deal with Liontown announced in July, the share price has succumbed to profit-taking. Of course, in current stock market conditions even an agreement with the Archangel Gabriel would most likely result in people taking money off the table. Today’s RNS fills some of the news vacuum since the summer.

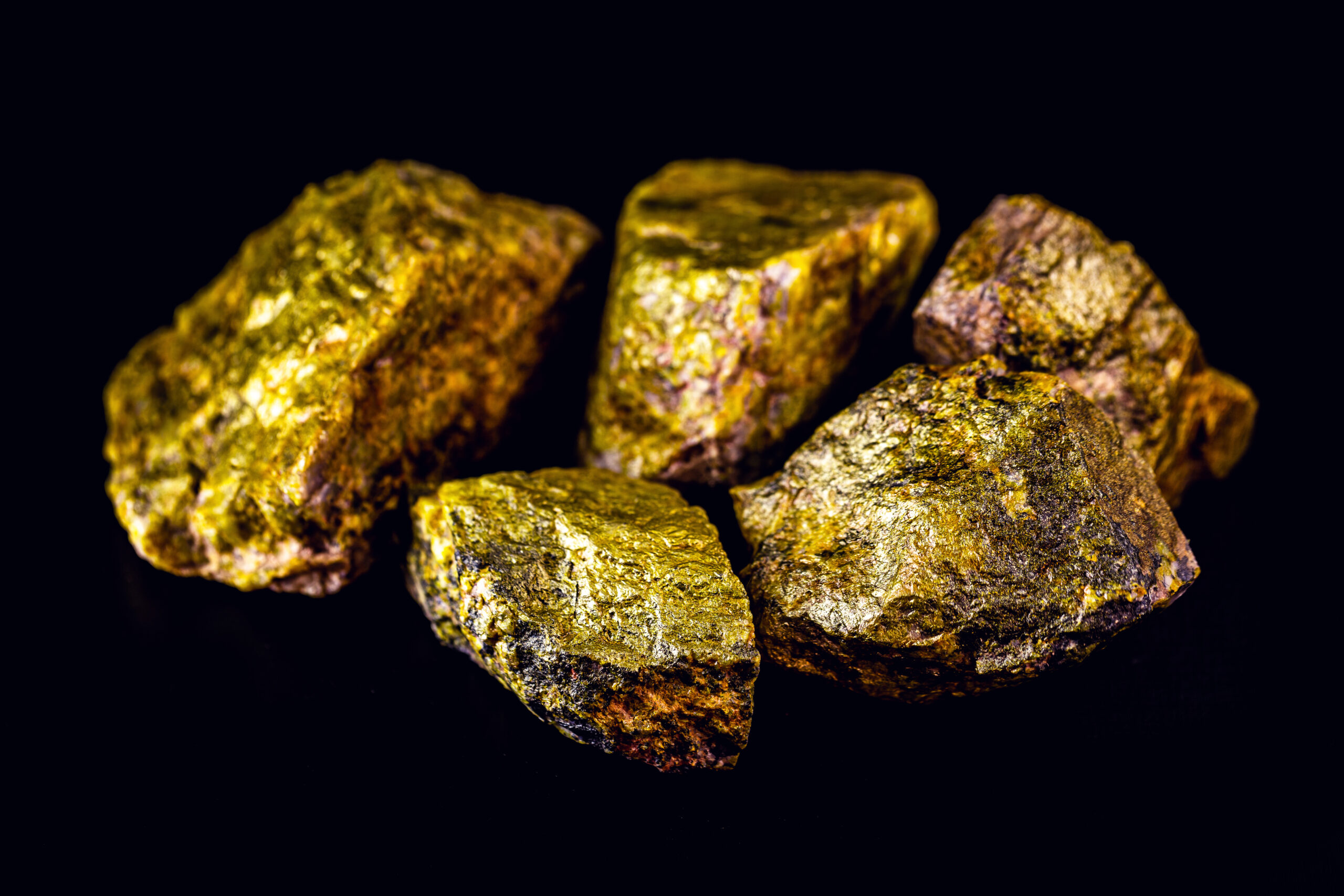

Power Metal Resources (POW), the London listed exploration company, announced key developments to its currently 100% owned uranium business, in and around the prolific Athabasca Basin in Saskatchewan, Canada. POW said this season’s uranium fieldwork continues to surpass its expectations in terms of the quality and number of significant targets discovered. Following very low acquisition costs, it believes it is now adding very considerable value to a portfolio with well thought out, methodical and inexpensive exploration, clearly demonstrating the ongoing success of its business model.

Comment: Given the way that uranium is currently the new lithium, one would expect at least a perfunctory rally in shares of POW from present lowly levels as the company has said its expectations have been surpassed.

Amaroq Minerals (AMRQ), an independent mine development corporation with a substantial land package of gold and strategic mineral assets across in Southern Greenland, provided the results of its 2023 exploration drilling programme at Nalunaq. The company said these are the highest grade drill results at Nalunaq since we founded Amaroq Minerals in 2017. This marks another step forward to meeting its internal objective of expanding its Mineral Resource at Nalunaq towards 1Moz and potentially beyond.

Comment: One would be delighted to be corrected on this, but the promise of Greenland should be that 1Moz is the minimum one would expect from such virgin territory.

NetCall (NET) Finals to June report strong trading with a 18% increase in Revenue to £36m with a 25% increase in EBITDA to £8m. This becomes a 74% increase in PBT to £4m and EPS of 2.52p for a P/E of 33x at 82.5p and a token dividend despite high cash balances. Netcall have been a provider of intelligent automation and customer engagement software for years and it cloud services sales improved 55% to £16.6m and there is a growing pipeline. It’s key markets of financial services, healthcare and Government seeking to automate processes and improve customer’s experience. The perhaps disappointing strategy is to accelerate organic growth by investing in product R&D which takes longer but is arguably less risk than by acquisition and has net cash is £24m.

Comment: The increased momentum already seems to be in the price. That said, the stock is well down on June resistance near 115p.

Hellenic Dynamics (HELD), a medical cannabis cultivator with a dedicated focus on producing THC dominant strains of medical cannabis flowers for the burgeoning European medical cannabis markets, confirmed confirm the beginning of cultivation. Following the announcement of 29 September 2023, Elgo Dimitra, the public research institute overseen by the Greek Ministry of Agriculture, has begun the cultivation of medical cannabis flowers for Hellenic Dynamics.

Comment: Unless you have been following HELD very closely, the news of first cultivation today may have taken some by surprise, and help the share price accordingly.

Cambridge Cognition (COG), which develops and markets digital solutions to assess brain health, announced that it has secured a significant contract for a sizeable later stage clinical trial, following a competitive tender. COG said this initial contract is valued at approximately £1 million and revenue is expected to be recognised over a two-year period, starting in 2023. There is potential for a further contract with the same customer, of slightly higher value, in 2024 once the initial results have been analysed from this trial.

Comment: Given the company’s propensity to be the strong, silent type as far as communicating with the market and explaining what it does, today’s excellent news has come in just in time to help the stock perhaps climb off 2 year lows.

Galileo Resources (GLR) provided shareholders with an update on the Kalahari Copper Belt Project in Botswana, Shinganda copper-gold project and the Star Zinc Project, Zambia. GLR said on its Kalahari project, it looks forward to receipt of the ionic leach sample results particularly with regard to Licence PL253/2018 and its location relative to reported discoveries on the two Cobre Limited licences located immediately east and west of our ground holding. Its interpretation of the results will drive subsequent follow up work most likely to include drilling. The Shinganda Project in its view shows significant copper and gold potential with gold values greater than typically experienced in Zambia.

Comment: Once again shares of GLR have returned to the 1p support zone ahead of today’s announcement. There is enough here to drag the stock back up to summer resistance over 1.3p again.

Strategic Minerals (SML), a profitable producing mineral company, announced that its 100% owned subsidiary Cornwall Resources Limited has signed a MOU with Oxford Sigma Limited, a nuclear fusion technology company based in Oxfordshire, UK. SML said it was pleased to be working with the Oxford Sigma team who have a deep understanding of the fusion energy industry within the United Kingdom and abroad. Oxford Sigma is working to develop a long-term supply chain approach to sourcing tungsten for this key developing future technology.

Comment: SML may be a profitable, producing mineral company, but in current stock market conditions one apparently needs a magic ingredient to get a decent rally. The deal with Oxford Sigma should be such a catalyst.

Author