CleanTech Lithium (CTL), an exploration and development company advancing sustainable lithium projects in Chile, announced the results of the Placing announced on 21 November 2023. The Placing has conditionally raised gross proceeds of £8 million and was increased from the original minimum fundraise target due to significant investor demand. CTL said the new funds will be focused on the development of the Laguna Verde project and provide flexibility for additional drilling at Francisco Basin. A drilling campaign will start imminently to upgrade the lithium resource estimate, with more resource being categorised as Measured and Indicated. The Pre-Feasibility Study (PFS) for Laguna Verde is well underway and the funds will ensure its completion and announcement to the market. Allocated funds will also see the commissioning and running of the Direct Lithium Extraction (DLE) Pilot Plant and production of battery grade lithium carbonate. The final components arrived in its facility in Copiapó recently and the plant is expected to be commissioned before the end of this year.

Comment: CTL gets its fundraise over the line, and then some, with £8m in the kitty. The cash is clearly going to take the company a long way on its timelines, especially in terms of the pilot plant. One would now regard anything under the IPO price of 30p as bargain basement territory from now.

Conroy Gold and Natural Resources (CGNR) announced assay results from a further three drillholes in the Derryhennet section of the Clay Lake gold target in the Longford – Down Massif. The results included a 41.5 metre gold zone at 0.5 g/t gold with grades up to 3.1 g/t gold. CGNR said the step out drilling programme on the Derryhennet section of the Clay Lake gold target is highly encouraging with additional wide zones of gold mineralisation intersected further indicating the overall gold potential of the Clay Lake gold target.

Comment: As if by magic, shares of CGNR have been rising this week ahead of today’s RNS. Clairvoyants will already have picked up on the decent graded revealed this morning.

OptiBiotix Health (OPTI), a life sciences business, announced that the University of Reading has provided a grant under the Biotechnology and Biological Science Research Council (BBSRC) to fund a research project on WellBiome®. OPTI said the award of this grant to investigate WellBiome’s impact on the gut microbiome throughout its length is another step in OptiBiotix’s strategy of developing science based functional ingredients which modify the human microbiome to improve health.

Comment: OPTI shares have been in a holding pattern since the summer, waiting for the next upward driver. Today’s RNS should at least allow the stock to consolidate well in the latest 25p-35p range.

Quadrise (QED) have at last successfully completed full commercial scale customer trial. It’s for its proprietary fuel technologies MASR and bioMSAR which provide shipowners, farmers, and builders a lower cost and lower carbon alternatives to fuel oil and biofuels. The client, with a facility in Morocco is one of the world’s largest container shipping and cruise liners and uses a lot of’ fuel. The parties will now enter discussions for a long-term commercial supply which should lead to revenues. There is no turnover and the loss before tax from the June 2023 year end increased to £3.62m. In July £1.9m was raised at 1.25p and added to existing cash gives an estimated £3m and 9-12month runway.

Comment: At 1.2p with an £18.5m mkt cap the ‘forever’ time scales and lack of certainly makes this very speculative.

GreenRoc Mining (GROC), a company focused on the development of critical mineral projects in Greenland, announced that it has raised gross proceeds of £460,786 at a price of 2.5 pence per Placing Share. The net proceeds of the Placing will primarily be used to complete the feasibility study of a graphite anode processing plant and to undertake ongoing work towards the completion of Environmental and Social Impact Assessment studies for the Company’s Amitsoq Project in Greenland. GROC said it is hugely satisfying that it now has the funding in place to complete the full feasibility study of the graphite anode processing plant. It will provide us with a comprehensive business case and clear path to building both the pilot scale and full production plant.

Comment: Given that we are just weeks away from Christmas, it is prime placing season, and GROC has pressed the button on a decent sized placing. That said, given that the stock was 4.5p at the beginning of this month, some may have successfully guessed a fundraise was on its way.

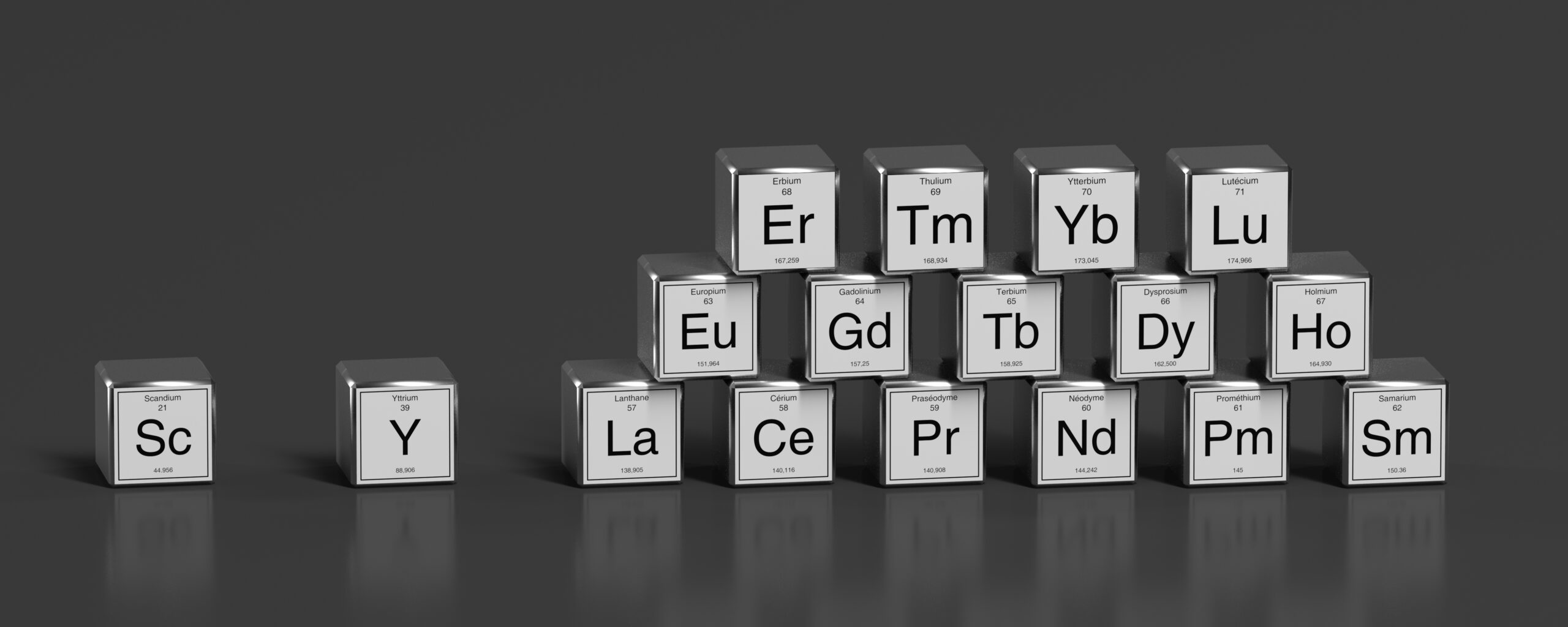

Cobra (COBR), an exploration company focused on the Wudinna Gold and Rare Earth Project in South Australia, announce it has been granted a 213 km2 exploration tenement in northern Tasmania. The tenement is complementary to Cobra’s ionic rare earth strategy as it is considered highly prospective for Ion Adsorption Clay hosted rare earth mineralisation. COBR said it seized an opportunity to secure this tenement adjacent to an outstanding ionic rare earth project with demonstrated low-cost metallurgy, similar to what it has discovered at Boland. IAC hosted rare earth deposits tend to have a higher contained basket value than hard rock deposits due to their higher content of valuable heavy rare earths.

Comment: While the market gets to grips with COBR’s overall REE merits, it is expanding its footprint, helped along by the recent fundraise.

Wishbone Gold (WSBN), announced it has secured an exclusive option to acquire 100% of the Crescent East Lithium and Gold Project, located in the prolific gold area of Mosquito Creek, in the Pilbara Region of Western Australia. The site is 260km south-east of Port Headland, the main point for the region’s lithium exports. WSBN said this is a very exciting new opportunity for Wishbone. Lithium is one of the hottest sectors in Australia and in the mining sector at the moment with the Pilbara responsible for some of the biggest new lithium mines and discoveries. Due diligence will be completed over the coming weeks and it looks forward to seeing the results.

Comment: WSBN gets on the highly popular lithium bandwagon, something which may in itself attract new shareholders, looking to get some leverage on the EV revolution.

Corcel (CRCL), the Angolan focused exploration and production company, announced the beginning of initial exploration efforts at the Company’s 100% owned Canegrass lithium project, in Western Australia. CRCL said it was excited to have its initial field team on site at Canegrass in Western Australia. With lithium remaining extremely attractive across Australasia and meaningful potential for nickel at the project, it expects these results to inform and guide its next steps at the site.

Comment: Another company pushing the lithium vibe which is so a la mode currently. One would expect CRCL shares to continue their recent successful assault on 0.5p.

Atlantic Lithium (ALL), the African-focused lithium exploration and development company, updated with regards to the development of the Company’s flagship Ewoyaa Lithium Project in Ghana, West Africa. ALL said following the grant of the Mining Lease in October 2023, it is now firmly on the path towards building Ewoyaa as Ghana’s first lithium mine. Alongside its ongoing, recently extended exploration programmes, which continue to add value to the Project, excellent progress is being made towards achieving shovel readiness.

Comment: We now start to find out why ALL rejected the recent bid moves, perhaps judging that it has done all the heavy lifting in terms of Ewoyaa, and that the fundamental momentum is now in its favour.

Pan African (PAF) provided an interim production update and details on construction progress at the MTR Plant. PAF said the expected production performance for the half year to December 2023 positions the Group to deliver excellent results for the full financial year. The continued momentum with the construction of the MTR plant at the Group’s Mintails Project is again testament to its track record of bringing world class tailings retreatment projects to account.

Comment: Shares of PAF have been in recovery mode since the summer. Perhaps the run up to “excellent” results will see the stock break recent 17p resistance with conviction.

Author