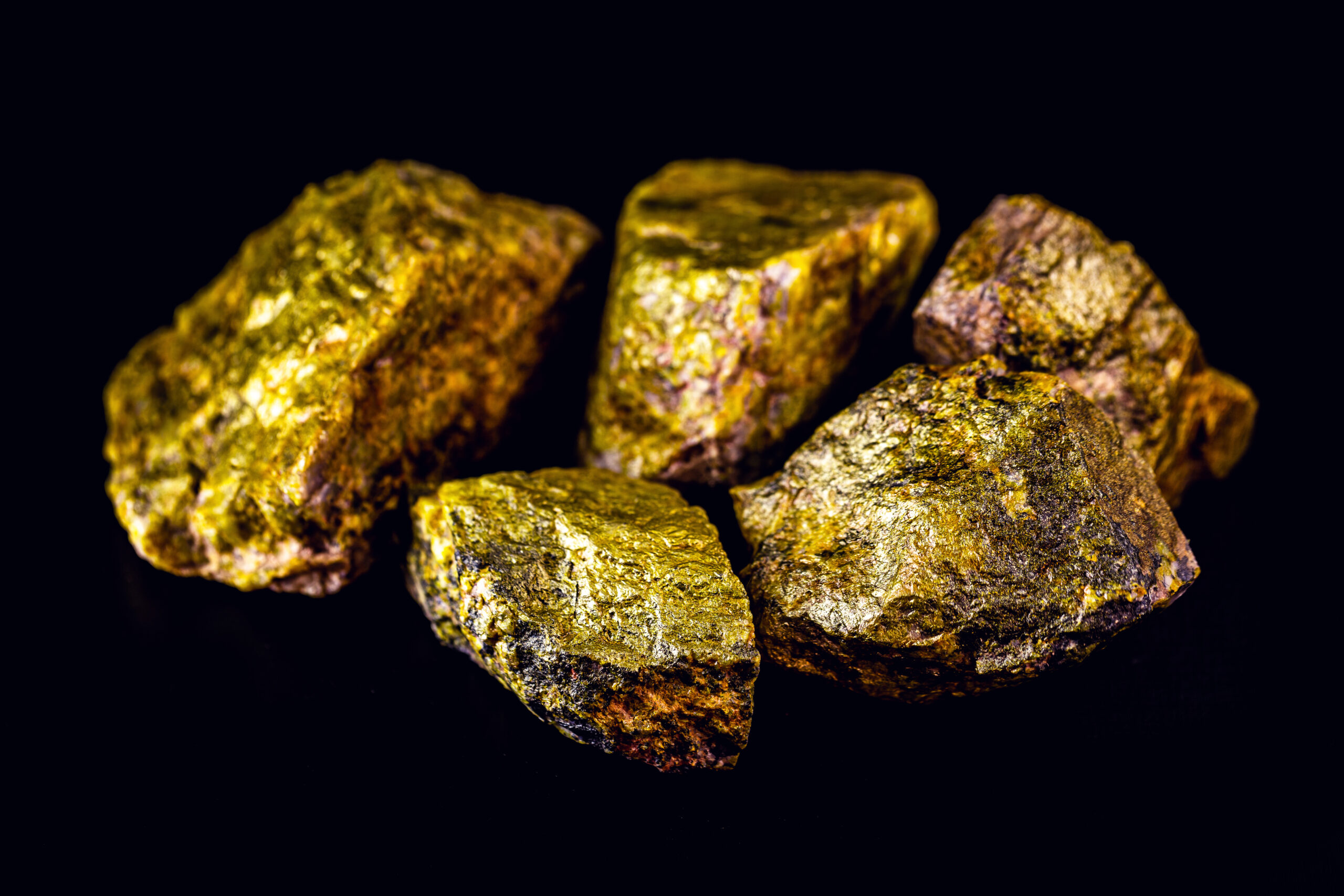

Neo Energy (NEO), the near term, low-cost uranium developer, is pleased to confirm that it has satisfactorily completed its technical, financial and legal due diligence on the acquisition of a 100% interest in the multi-million pound uranium and multi-million ounce gold resources of the Beisa North and Beisa South Uranium and Gold Projects. NEO said its advisors and South African lawyers are now finalising the legal documentation for the acquisition. The Company anticipates the signing to be completed by no later than 30 September 2024.

Comment: One of the secrets of a successful small cap company is the ability to pull rabbits out of hats. In the case of NEO, its Beisa deal has more rabbit than Watership Down. The shares have gone into mid move consolidation mode since then, with a potential measured move target by the end of next month north of 1.5p.

GSK (GSK) said it welcomed today’s Daubert ruling by the Florida State Court. In excluding plaintiffs’ expert testimony as unreliable, GSK will now seek dismissal of the upcoming Wilson case in Florida – whereby plaintiffs alleged a causal link between ranitidine and prostate cancer. GSK said today’s decision echoes the December 2022 ruling by Judge Rosenberg in the federal multidistrict litigation (MDL), which rejected all expert evidence put forward by the plaintiffs and dismissed all MDL cases alleging bladder, esophageal, gastric, liver, or pancreatic cancer. Both the MDL and Florida courts have determined that the methodology used by plaintiffs’ experts is unreliable and fails to meet the Daubert standard for scientific evidence.

Comment: GSK reminds us, if we needed it, how much lawyers, lawfare and litigation are a blight on society. Clearly, companies of the size of GSK can afford to waste time and shareholders’ money in the courts, the rest of us cannot.

Author